Congratulations on hiring your first employee(s). That's a big step for any business!

Of course, it’s not as simple as hiring an employee and writing payroll checks. That would be nice though! There is a lot to know and many steps to take to handle the entire process from initial hire to annual W-2.

The good news, the task listed in step one is one time. Some of the tasks in step two are one time and others will need to be revisited from time to time. I admit, the process is pretty daunting initially, but it does get better! Let’s get started!

First, I want to clear up terminology. The term employee ALWAYS refers to an individual a company hires, pays via payroll (taxes are withdrawn), and issues a W2.

A worker that is paid as an Independent Contractor (1099) is NOT an employee. This term should not be used when referring to this individual.

It’s really important to use the proper terminology. The topic of Independent Contractor vs. Employee is a long one and we aren’t going to cover that here.

Below, we cover a long list of what needs to be done before hiring the first employee and what needs to be done routinely thereafter. Please keep in mind, there could be other enrollments, filings, or tasks that your business will need to perform. Be sure to check the laws in your state.

1. Set up Your Business to Hire Employees

When you hire your first employee, you will need to register (enroll) with various state and federal agencies in order to process and remit payroll filings. These include but are not limited to:

- Request an EIN if you don’t already have one. EIN stands for Employer Identification Number and is required for all businesses that process payroll. It’s a number used to identify a business entity.

- IRS EFTPS System -In short, this is where you will remit payroll taxes such as employee withholding. This will also include the company match for Social Security and Medicare. As well as, the annual filing for Federal Unemployment Tax (FUTA).

- State Revenue Department (if your state has state income tax) – This is where you will remit state taxes withdrawn from an employee’s paycheck.

- State Workforce Commission – This is where you will remit your portion of State Unemployment Tax.

- State’s new hire program – Once registered you will need to report new hires within a certain amount of days of hire. (This program assists the state to determine if new hires are on unemployment or if they owe child support.)

- You might need to apply for Worker’s Compensation Insurance. Check the laws in your state for your industry.

Once you enroll with these agencies, be sure to keep all paperwork and online account login information in a safe place. You will need to refer back to this information from time to time and it can be a hassle to request this information.

2. Create Payroll Procedures

Post required notices – Research the type of workplace posters required for your industry and where they must be posted.

Determine payroll schedule – This is really important. You need to decide how often you will pay employees. Such as weekly or every other week. Once you determine a schedule you need to stick with it.

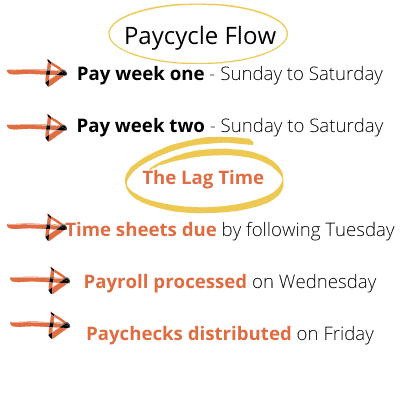

You also need to determine the lag time between the pay period and the payday. For instance, first, you decide to pay employees every other Friday. The next step is to determine what days will be on the paycheck. You will need to have time for gathering employee time reports and payroll processing (the lag time). If you pay via direct deposit, the lag time will also need to account for the time the bank requires for electronic settlement. My preference is 7 days between the payroll period end and payday.

In this scenario, the employee would work two weeks with the workweek starting on a Sunday and ending on a Saturday. Timesheets and any reimbursement documents would be due by the Tuesday following the last day of the pay cycle. At that time payroll would be processed and the employee would receive their paycheck on Friday. See the example graphic below.

Select a payroll system or outsourced provider

Learn federal and state payroll laws. Such as overtime, work breaks, and required benefits.

Pro Tip: Don’t think that just because you don’t want to pay overtime that you don’t have to. It is the law to pay overtime at a rate of at least time and one half for employees that work over 40 hours in a workweek (unless the IRS states the employee type is exempt). This is one reason why a payroll schedule is so important.

There are many other procedures that a business should consider (such as, developing an employee manual) but we are only covering the ones that pertain specifically to payroll.

3. Employee Paperwork

When you hire your first employee and subsequent employees, they will each need to complete various forms. These include but are not limited to:

- Job Application – Have each new employee complete a job application and keep on file.

- I-9 Form – This form verifies the identity and employment authorization of the potential employee.

- W-4 Form – This form tells the employer the amount of withholding for the employee.

- Direct Deposit Form, if applicable. If you will be paying employees via direct deposit, they will need to complete this form giving you permission to auto-deposit their pay.

- Equipment form, if applicable. If you loan employees laptops, phones, printers, or the like it’s beneficial to have an equipment form explaining policies and return procedures.

Pro Tip: Keep the completed I-9 form separate from the employee file. That way if a governing authority asks to inspect I-9’s you will only be providing the document requested.

4. Payroll Taxes & Form Filing

Once you have processed your first payroll you need to be prepared to remit taxes and file forms when due. It’s important you know the timeframe the IRS requires your business to remit payroll taxes. They will alert you in the initial paperwork.

There are monthly, quarterly, and annual payments. You need to know the schedule for each of these for your business. These taxes include but are not limited to:

- 941 -This payment represents the employees withholding and the company’s match of Social Security and Medicare. This is a routine payment that is paid at least once a month. The IRS bases the frequency of payment on the actual amount of payroll.

- 940 – This is the annual FUTA Tax. Some employers pay this every January, and some pay throughout the year. Again, the frequency depends on the amount of payroll.

- State Unemployment – The frequency of this payment will be based on your state. In Texas, it’s due quarterly.

- State Payroll Tax – If you’re subject to state income tax you will need to pay this based on your state’s schedule. (If your state doesn’t have a state income tax you will not have this tax.)

Form Filings:

For each of the above tax payments, there are also routine form filings. These are usually called information filings and can be due monthly, quarterly, or annually. For example, your business’s 941 payment might be due once a month. In addition to the payment, you will also have a 941 form filing each quarter that recaps each payroll during the prior quarter and reconciles to the amount paid during that quarter.

- 941

- 940

- State Unemployment

- State Payroll Tax

- W-2 – This is a tax document that is given to each employee in January that states all pertinent information regarding wages paid and taxes withdrawn. The employee needs this form to file their income taxes. Your business will also file a copy with the IRS (known as a W3).

The takeaway here, there is more to the process than making payments. Create a payroll schedule so you won’t miss any of the deadlines.

I know that’s a lot of information! It’s proof that you must get organized and have systems in place to be able to handle all of the pieces seamlessly.

As a final reminder, please be diligent in paying the various taxes and submitting information filings when due. Don’t get caught in the trap of owing back taxes, fees, penalties, interest, etc. It can be hard to pull your business out of the trap once in.

If you like this article leave a comment. If you want to learn more business basics be sure to check out our guidebook, ”Becoming a Sensible Business Owner.”

~ Brandon & Christi are successful business owners who enjoy traveling and making a mess in the kitchen with their two daughters.

The article is for informational purposes only and should not be construed as business, accounting, tax, or legal advice. Details are subject to change without notice.

Copyright © 2020-2022, Brandon & Christi Rains, Rains Group LLC DBA The Sensible Business Owner, ALL RIGHTS RESERVED